The evolution of enterprise IoT asset tracking: From locating assets to optimizing operations

In short

- Asset tracking has become an integral part of enterprise operations, with large firms tracking over 166,000 assets daily, according to IoT Analytics’ IoT Asset Tracking & Visibility Adoption Report 2025.

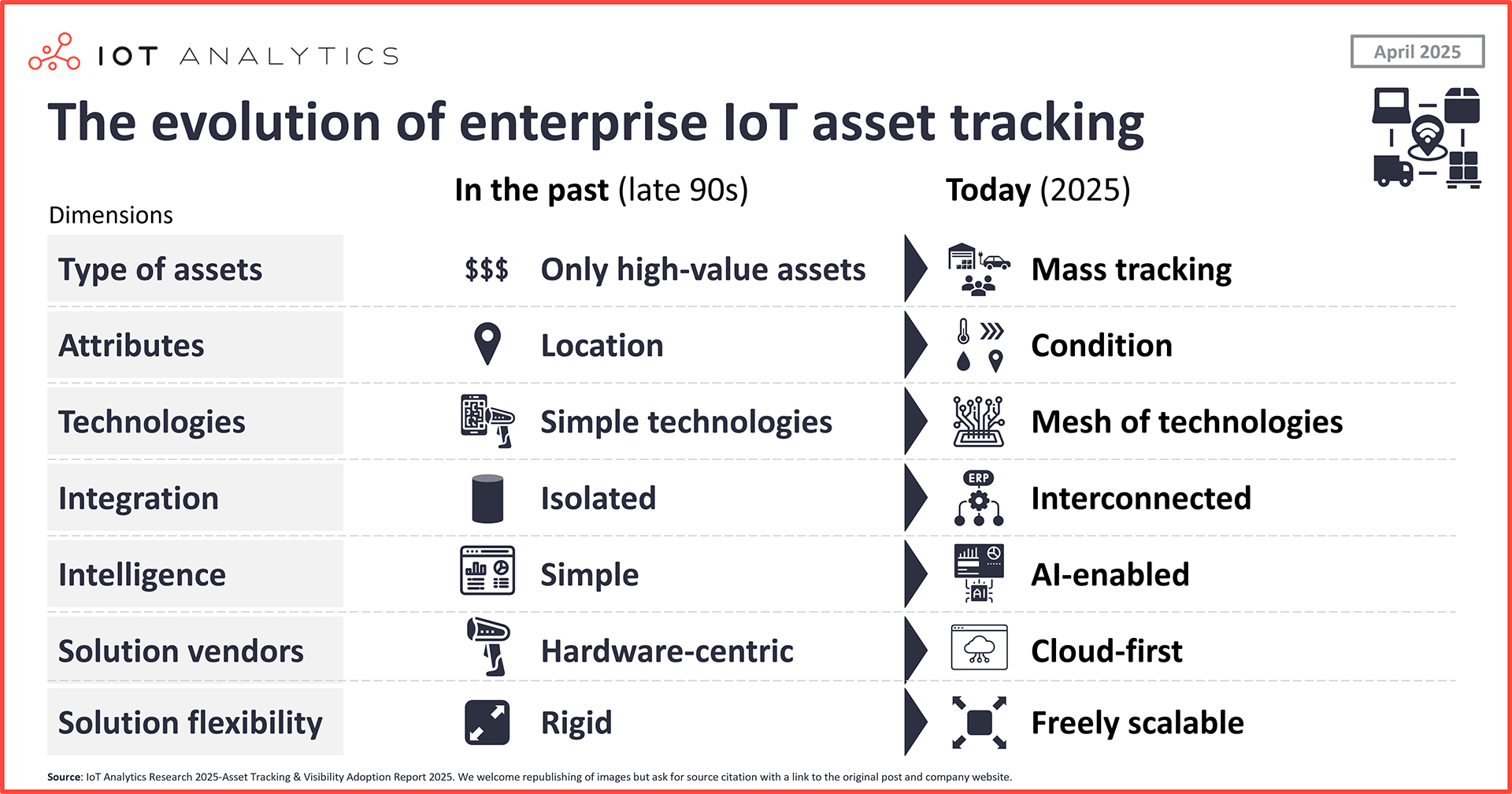

- Enterprise IoT asset tracking has evolved across 7 dimensions: 1) asset type, 2) attributes tracked, 3) technologies used, 4) enterprise application integration, 5) intelligence provided, 6) vendor solutions, and 7) solution flexibility.

- Despite technological progress and growing adoption, the market remains fragmented, with persistent challenges—particularly around system integration and achieving true end-to-end supply chain visibility.

Why it matters

- For IoT asset-tracking solutions providers: As the market further matures, vendors need to focus on interoperability, integration with enterprise systems, and flexible pricing models to capture growing demand.

- For IoT asset-tracking adopters: With solutions maturing and new offerings released, adopters should reassess where asset tracking delivers measurable returns, identify opportunities to upgrade existing systems, and ensure alignment with broader digital transformation goals.

The insights from this article are based on

IoT Asset Tracking & Visibility Adoption Report 2025

A 142-page report on enterprise asset-tracking projects in manufacturing, mfg. supply chains, construction, retail, energy, incl. insights on implementation, vendors in use, spending patterns, ROI, challenges, and success factors.

Already a subscriber? View your reports here →

Asset tracking has become an integral part of enterprise operations. The average large enterprise tracks over 166,000 assets on any given day, according to IoT Analytics’ IoT Asset Tracking & Visibility Adoption Report 2025 (published April 2025). The report shows that enterprise asset tracking has matured over the last 3 decades and is no longer limited to GPS trackers on a few high-value items. It has evolved over multiple dimensions to become a core technology, in many cases an important element of key operational processes. IoT Analytics estimates that today, 3.7 billion (20%) of the 18.8 billion globally connected IoT devices can be classified as IoT asset tracking.*

*Note: The 166,000 assets for enterprises are not fully comparable to the 3.7 billion global assets being tracked, as definitions slightly differ. The IoT asset tracking report 2025 does include barcodes and RFID in its number, whereas the global number of IoT connections excludes these 2 technologies.

Adoption of IoT asset tracking in recent years has been driven by 4 key factors:

- Supply chain disruptions (e.g., the COVID-19 pandemic and Middle East conflicts)

- The desire for higher operational efficiency (e.g., improving scheduling and fuel efficiency of vehicles)

- Risk management considerations (e.g., rising asset values and security risks, such as theft and data breaches)

- Companies expanding existing tracking operations as they scale their business (e.g., higher production or entering new markets)

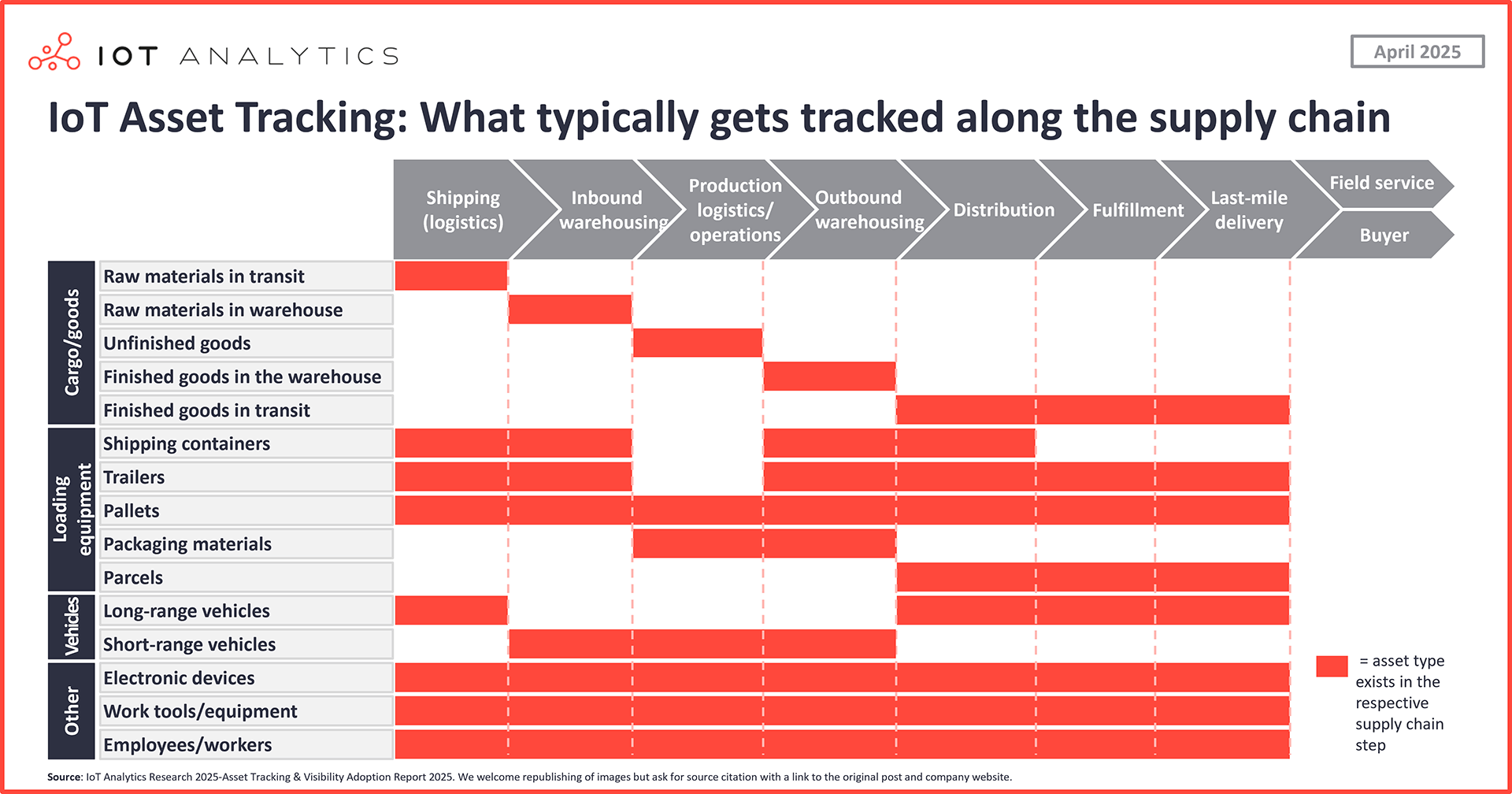

IoT asset tracking has seen widespread adoption across the value chain for different goods, loading equipment (e.g., shipping containers), vehicles, and even people. It plays a key role not only in shipping and warehousing but also inside facilities (especially in production).

Key quote from an IoT asset tracking adopter

“We continue to increase our spending on enhanced asset monitoring capabilities via GPS and telematics. These technologies help us optimize routes, schedule maintenance, and improve fuel efficiency, ultimately boosting operational efficiency and achieving cost savings.”

Chief X officer (CxO) of a machinery & equipment manufacturer in EMEA

With so much to track, it is no surprise that IoT Analytics research into IoT use case adoption in 2024 found that 3 asset tracking use cases appear in the top 10 most adoption IoT use cases: 1) supply chain track and trace at 54% of projects, 2) on-site facility track and trace at 50%, and location tracking at 45%.

| IoT asset tracking definition The process of monitoring the location, status, and/or movement of mobile physical assets—such as moveable equipment, inventory, tools, or vehicles—within indoor (e.g., warehouses, offices, or plants) or outdoor (e.g., in-transit) environments using technologies like GPS, RFID, barcodes, or IoT sensors. |

The evolution of enterprise IoT asset tracking

The report—based on an extensive survey of 100 enterprises that use IoT-based asset-tracking solutions in their operations (e.g., manufacturing, retail, or construction)—shares the most tracked assets, the use cases enabled by asset-tracking solutions, the most used technologies, and how companies approach the decision to buy or build their solutions—with a look at the most used vendors and their satisfaction scores from end users.

Insights from the report show an evolving industry along 7 dimensions:

- Types of assets being tracked

- Asset tracking attributes

- Asset tracking technologies

- Asset tracking integration

- Asset tracking intelligence

- Asset tracking solution vendors

- Asset tracking solution flexibility

Types of assets: From tracking only high-value assets to mass tracking

Nearly 90% of organizations now track finished goods; over half track employees. Historically, asset-tracking systems concentrated only on expensive or mobile items like long-range vehicles and electronic devices. Over the years, asset tracking has shifted to encompass a wide range of asset types, including finished goods in the warehouse (89% of companies), short-range vehicles (74%), and even employees (54%).

Example: Tracking workers in a facility

Salco, a tailor-made door solutions company based in the Netherlands, implemented an indoor real-time location system using ultra-wideband (UWB) technology and 22 fixed sensors to track products, equipment, and employees on the factory floor with 10cm precision. Operators pick up unassigned tags at the start of each shift, enabling the system to track labor inputs to products without collecting personal data. The associated software provides visualization tools, buffer warnings, idle station alerts, and detailed cost reporting functionalities. Salco reports that the system led to a 20% improvement in cost calculation accuracy and reduced manager floor time by more than 50%.

Asset tracking attributes: From only tracking location to tracking condition and more

Temperature tracking has become widespread. In the late 1990s, asset tracking was considered somewhat of a revolutionary development. In 1996, US President Bill Clinton issued a policy directive to make GPS a dual-use system, benefiting both military and civilian users. Later, in 2000, Clinton directed the US government to end the use of Selective Availability, making GPS more responsive to civil and commercial users.

These policy directives paved the way for the development of GPS-based asset-tracking solutions for commercial purposes. The first asset-tracking solutions that could merely track location cost upwards of $1,000. Today, location tracking is often a low-cost, subscription-based baseline feature, with asset-tracking companies offering additional services at various, relatively affordable price points. While the IoT Asset Tracking & Visibility Adoption Report 2025 breaks down median asset-tracking spending per asset by region, industry, and company size, the overall median spending globally for asset tracking is $110 per asset per year across different technologies and assets.

Further, the report shows that while 98% of companies track location as a primary asset attribute for at least one asset, temperature (69%) and humidity (58%) are the second and third most commonly tracked attributes. This shift has been particularly crucial in sectors like pharmaceuticals and food logistics, where environmental conditions directly impact product integrity.

Asset tracking technologies: From simple tech to a technology mesh

More than half of companies use passive RFID and Wi-Fi to track assets, while barcodes and GPS remain most popular. Asset tracking has evolved from relying on basic barcode systems and GPS to leveraging a broad range of tracking technologies, including IoT devices and sensors. While 86% and 77% of respondents still use barcodes/QR codes and GPS, respectively, to track at least one asset type, passive RFID (59%) and Wi-Fi (53%) have become the third and fourth most common technologies.

For decades, GPS was the go-to solution for tracking long-range assets like vehicles, while barcodes facilitated basic inventory management. However, as businesses sought more precision and flexibility, technologies like RFID, Bluetooth Low Energy (BLE), and Wi-Fi became increasingly popular. RFID, for example, enables contactless scanning, while BLE offers low-power tracking for assets in confined spaces. Other technologies used include cellular, low-power wide-area (or LPWA), or UWB connectivity. Today, these technologies are often combined, allowing organizations to track assets in diverse environments. This convergence of technologies has led to more accurate, real-time visibility, helping businesses make smarter, data-driven decisions.

Asset tracking integration: From an isolated solution to enterprise integration

Nearly 3/4 of companies integrate their IoT asset-tracking solutions with ERP software. Initially, many asset-tracking systems operated in silos, focusing solely on tracking assets without interacting with other enterprise applications. IoT Analytics research for the IoT asset tracking and visibility report found that, today, 74% of companies use ERP software to support their asset-tracking implementations for at least one asset. Germany-based enterprise software company SAP’s ERP software is the most used ERP application, with 39% of respondents reporting using the company’s solutions as part of their asset-tracking projects.

IoT asset tracking and ERP integration happen on several layers. The table below shows 7 typical SAP modules that get integrated with asset tracking.

| SAP module | Key reasons to integration | Typical user |

|---|---|---|

| SAP MM (materials management) | To update inventory records with real-time data | Procurement/logistics |

| SAP EWM/WM (extended warehouse management) | To track assets in large yards or facilities | Logistics/warehouse operations |

| SAP TM (transportation management) | To provide real-time GPS tracking, delivery ETAs, and route performance monitoring | Logistics/transportation |

| SAP EAM (enterprise asset management) | To support enterprise-wide asset visibility, lifecycle tracking, and performance benchmarking | Operations/maintenance |

| SAP PM (plant maintenance) | To trigger work orders based on usage, schedule preventive maintenance, and reduce unplanned downtime | Maintenance |

| SAP FSM (field service management) | To provide real-time asset location data to optimize technician dispatch, automate service triggers, and validate execution | Field/customer service |

| SAP FI-AA (financial accounting–asset accounting) | To support decisions on asset reallocation, retirement, or impairment based on operational status | Finance/accounting |

Asset tracking intelligence: From simple dashboards to AI-enabled predictions

AI-powered predictions are adding the next layer of value to IoT asset-tracking solutions. Asset tracking is evolving beyond static dashboards and reactive monitoring into dynamic systems driven by AI. Today, AI algorithms process real-time data from connected assets to deliver predictive insights—such as estimated times of arrival (ETA), potential delays, and maintenance needs—across multi-modal transportation networks. These predictions are continuously updated as conditions change, allowing businesses to proactively adjust logistics plans, reduce downtime, and improve customer communication. The shift toward AI-enabled forecasting is transforming asset tracking from a visibility tool into a strategic capability for supply chain optimization.

Example: Hapag-Lloyd rolls out AI-powered ETA tracking across its container fleet

Hapag-Lloyd, a Germany-based transport and shipping company, equipped over 1.5 million containers—90% of its global fleet—with smart tracking devices integrated into Netherlands-based location data, mapping, and navigation company HERE Technologies’ AI-powered asset visibility platform. These devices provide Hapag-Lloyd customers with real-time location data and predictive inland ETAs across rail, truck, and barge networks. In addition to real-time tracking, the platform includes adjustable geofencing for event-based alerts, supports post-trip analytics, and integrates with enterprise systems through a standardized API. Hapag-Lloyd reports that the system is designed to significantly improve global supply chain visibility and enable more proactive logistics planning.

Asset tracking solution vendors: From legacy providers to new innovators

Cloud-first players reshaping the IoT asset-tracking landscape. Asset tracking has brought up a new class of vendors that offer advanced, flexible solutions, often with a cloud-first software offering. Prominent hardware-centric offerings in the early asset-tracking days included solutions from US-based asset intelligence solutions provider Zebra Technologies and US-based diversified technology and manufacturing company Honeywell.

Today, while many of these legacy companies are still in business with a wider range of tracking solutions, the evolution of asset tracking (in terms of integration and the technology used) has brought about a number of new vendors that have carved out market leadership in their respective segments. The report identifies a total of 115 vendors that are in use with the 100 enterprises surveyed for the report. One example is US-based IoT solutions company Samsara, which was founded in 2015. When looking at vendor usage in the IoT Asset Tracking & Visibility Adoption Report 2025, 5% of companies have used Samsara tracking solutions, which include traditional GPS trackers capable of including various sensor data and Samsara Operations Platform, a cloud-based platform aimed to help businesses manage and optimize operations using IoT data and real-time insights. There are dozens of other companies that have come up in recent years, including: Nexxiot, a Switzerland-based asset intelligence company focused on rail and intermodal logistics, founded in 2015; Kinexon, a Germany-based asset tracking solutions provider focused on industrial indoor tracking, founded in 2012; and Wiliot, an Israel-based asset-management company that focuses on ambient IoT (battery-free IoT sensing tags), founded in 2017.

Asset tracking solution flexibility: From rigid to flexible, scalable systems

Flexible pricing models are making enterprise asset tracking more scalable. Traditionally, high upfront hardware costs and complex monolithic software deployments limited adoption to large-scale, high-value assets. However, many of today’s offerings are highly modular, allowing companies to add or subtract assets being tracked. The nature of subscription-based offerings lowers the barrier to entry and allows companies to pay for what they end up using. According to the report, nearly one-third (30%) of asset-tracking projects are now considered “freely scalable” without additional infrastructure costs, while another 35% require only marginal investment to scale further. This shift allows organizations to gradually expand their tracking footprint—from initial pilots to enterprise-wide deployments—without overhauling their systems or breaking their budgets.

Analyst take: Enterprise IoT asset tracking has become a dynamic space, but challenges remain

Over the years, IoT asset tracking has gone from being a singular, isolated, unscalable application based on one technology to a mesh of technologies, many attributes, and deep enterprise integration. Riding this wave of evolution are hundreds of new vendors that have cropped up over the past few decades—some of which have seen impressive revenue growth.

That said, the industry is still quite fragmented, and challenges persist. According to the IoT Asset Tracking & Visibility Adoption Report 2025, enterprise integration is the top challenge for adopters, and for some, the business case for IoT asset tracking adoption remains unclear.

On top of these challenges, true end-to-end supply chain visibility is still rare. However, in the last 3–5 years, companies have gained traction in addressing this need, aiming to make full visibility across various types of assets and different vendors a reality. One example is US-based supply chain visibility platform provider project44—while not an IoT company, project44’s platform helps aggregate data from across supply chains, leveraging IoT and other data to give users fuller insights. Still, at this time, even solutions such as these are limited to specific data points and do not necessarily allow for full supply chain visibility of a given company, including raw materials, production logistics, and finished goods.

Will we see a true technology convergence in the coming years—where different indoor and outdoor asset tracking solutions across different technologies (e.g., barcodes, BLE, and UWB) are managed on one platform for true end-to-end visibility? Or will the industry continue to separate vehicle solutions from indoor asset tracking and warehouse solutions? And will be the true effect of AI?

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention to the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Are you interested in learning more about enterprise asset tracking?

IoT Asset Tracking & Visibility Adoption Report 2025

A 142-page report that explores the real-world adoption of IoT-based asset tracking and visibility solutions. Based on a global survey of 100 qualified decision-makers, the report investigates how companies track physical assets using technologies like GPS, RFID, and IoT sensors.

Already a subscriber? View your reports here →

Related articles

You may also be interested in the following articles:

- The top 10 IoT use cases.

- State of enterprise IoT in 2025: Market recovery, AI integration, and upcoming regulations

- The leading generative AI companies

- The 9 most demanded IoT system integration services

Related publications

You may also be interested in the following reports:

- State of IoT Spring 2025

- Generative AI Market Report 2025-2030

- IoT Use Case Adoption Report 2024

- IoT System Integration and Professional Services Market Report 2024–2030

Related market data

You may be interested in the following IoT market data products:

- Global IoT Enterprise Spending

- Global Cellular IoT Connectivity Tracker & Forecast

Subscribe to our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.

Leave a Comment