Winning in the asset tracking market: 5 lessons from adopters

In short

- Adopters of IoT Asset Tracking solutions want great support and integration over extensive features, according to IoT Analytics’ IoT Asset Tracking & Visibility Adoption Report 2025.

- 74% of asset-tracking projects either meet or exceed ROI expectations with in-house solutions underperforming external solutions.

- Cost is a key consideration for adopters but security ranks nearly equally high.

- Inventory management is currently the top use case but employee tracking is seen as the next growth segment.

Why it matters

- Asset-tracking vendors: With companies seeing their asset-tracking projects meet or exceed ROI expectations, vendors must understand their target clients and how to best market their products.

- Asset-tracking adopters: Asset tracking is delivering results for adopters, and understanding how peers feel about their solutions and the vendors they have worked with can help end users get the most out of their investments.

The insights from this article are based on

IoT Asset Tracking & Visibility Adoption Report 2025

A 142-page report on enterprise asset-tracking projects in manufacturing, manufacturing supply chains, construction, retail, energy, incl. insights on implementation, vendors in use, spending patterns, ROI, challenges, and success factors.

Already a subscriber? View your reports here →

Most asset-tracking projects deliver expected returns. On average, companies spend $110 per asset annually to track their inventory, equipment, or vehicles, according to IoT Analytics’ IoT Asset Tracking & Visibility Adoption Report 2025 (published April 2025). These investments appear to be paying off, as 74% of these projects meet or exceed ROI expectations.

The report, based on feedback from 100 decision-makers across industries like manufacturing, retail, and construction, goes beyond implementation stats like these to highlight what buyers want from vendors and their satisfaction with the asset-tracking solutions they have implemented. Below are 5 takeaways vendors should know to better serve their customers.

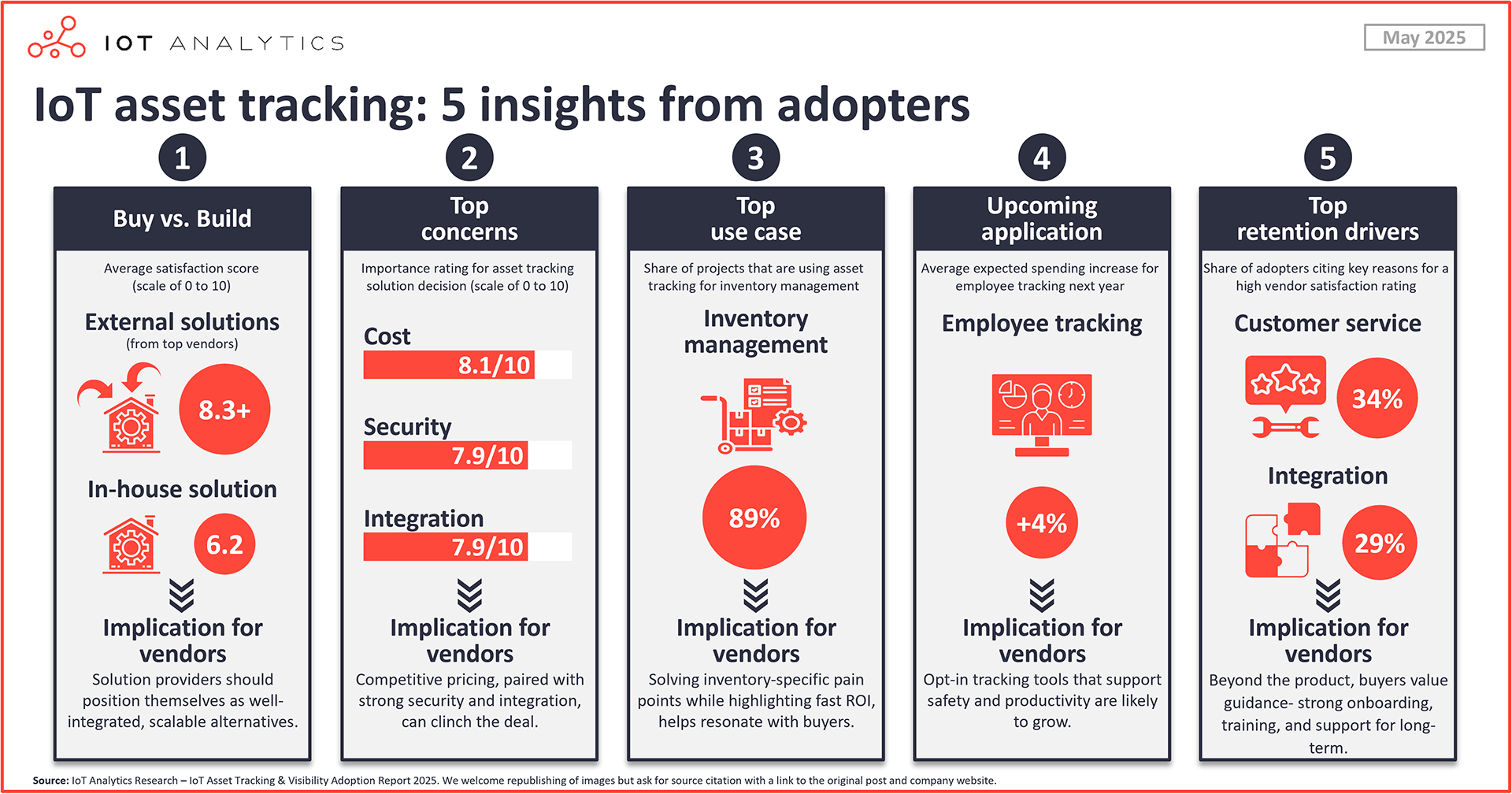

5 insights from asset tracking adopters

1. In-house solutions are underperforming—showcase why buying can be better

In-house tools score the lowest on satisfaction. 12% of companies rely on in-house asset-tracking tools, and this group reports the lowest satisfaction scores—just 6.2 out of 10, compared to 8.3+ for top vendors like US-based Oracle and Samsara.

According to the research, the key drivers for the less-than-average score are lack of reliability, poor integration with business systems, and insufficient support or training. Adopters frequently describe internal builds as inefficient and hard to scale.

Select adopter quotes about in-house asset-tracking solutions

“The system is not reliable, and nobody can offer training to employees on how to use it.”

CXO of a rubber & plastics company in EMEA

“The custom solution is not efficient, and the UI is not intuitive at all.”

Director at a machinery & equipment company in APAC

Takeaway for the vendors

Solution providers should position themselves as well-integrated, scalable alternatives—especially for customers who are resource-constrained or have outgrown their DIY approach.

2. Cost is key, but security is a top concern

Cost is the #1 concern of asset-tracking adopters, but security is a close second. Cost ranks as the top decision criterion (8.1/10), especially in the Americas and among mid-sized companies. Pricing pressures are increasing, and according to recent IoT Analytics research into the impact of tariffs on the economy and businesses, vendors and buyers are already implementing or forecasting general price increases—vendors must be transparent with their pricing and offer clear value.

But security and integration are not far behind (7.9 each). In fact, security outranks cost in EMEA and the process manufacturing sector. Process manufacturing’s preference toward security aligns with broader findings from IoT Analytics research supporting Microsoft’s May 2025 white paper, Artificial Intelligence in Process Manufacturing, which identified data security as a top barrier to digital tech adoption in process industries.

Takeaway for the vendors

Competitive pricing matters—but pairing it with robust security protocols and strong integration capabilities can clinch the deal.

3. Inventory management is the top use case

Nearly 9/10 asset tracking solutions involve inventory tracking. When it comes to practical deployments, inventory management is the clear leader—89% of adopters report using asset tracking for it. This outpaces other popular use cases like warehouse management, utilization monitoring, and fleet tracking.

Supporting this focus, finished goods in warehouses are the most tracked asset type, monitored by 90% of respondents. These are often high-value or high-volume items where real-time visibility can make or break supply chain performance.

Takeaway for the vendors

To resonate with buyers, focus your messaging on solving inventory-specific pain points—such as shrinkage, stockouts, and replenishment lags—while highlighting fast ROI.

4. Employee tracking the next growth segment

Employee tracking sees the fastest spending rise. Among the 15 asset types covered in the report, employee and worker tracking is projected to see the biggest increase in spending in 2025 (+4%), outpacing vehicles and shipping containers.

While few companies have fully matured their use of employee tracking, the intent is clear: There is rising interest in monitoring labor efficiency, safety, and time-on-task metrics, particularly in industries like manufacturing and construction.

Takeaway for the vendors

Privacy-conscious, opt-in tracking tools that enhance safety and productivity are likely to gain traction. Solutions that respect worker autonomy while generating useful operational data will stand out.

5. It is not just the features that sell—adopters want support and integration

Service and integration drive vendor loyalty. Good customer service and strong integration matter more than raw functionality. Among those most satisfied with their vendor, 34% cited customer service and 29% mentioned easy integration as key reasons.

By contrast, the most common complaints were poor support (29%), missing features (26%), and system complexity (21%).

Select adopter quotes about in-house asset-tracking solutions

“Service and support model is exceptionally strong for our account.”

Director/head of division/head of a site of a rubber & plastics company in the Americas

“[The vendor] provides dependable connectivity solutions and outstanding network infrastructure, ensuring smooth integration and scalability, considerably increasing the efficiency of asset tracking across our operations.”

CxO of a machinery & equipment manufacturer in EMEA

Takeaway for the vendors

Beyond the product itself, buyers value guidance. Investment in onboarding, training, integration toolkits, and responsive troubleshooting will pay off—not just in sales, but in long-term customer retention.

Asset tracking buyers are sophisticated—sales strategies should be too

Today’s asset-tracking buyers are not just procuring tech—they are selecting strategic partners. As this report shows, they care deeply about cost, compliance, usability, and long-term support. Features alone will not win their trust.

The above are just 5 of many insights gleaned from the research. The full IoT Asset Tracking & Visibility Adoption Report 2025 explores ROI trends, vendor benchmarks, industry-specific adoption patterns, and implementation tips straight from practitioners. For vendors, it serves as a roadmap to commercial relevance in an increasingly demanding market.

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention to the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Are you interested in learning more about IoT asset tracking adoption?

IoT Asset Tracking & Visibility Adoption Report 2025

A data-centric market research publication based on a global survey of 100 qualified decision-makers. This report highlights adoption levels, tracked asset types, vendor involvement, and spending patterns across industries, offering C-level executives and strategists a comprehensive reference point for benchmarking.

Already a subscriber? View your reports here →

Related articles

You may also be interested in the following articles:

- The evolution of enterprise IoT asset tracking: From locating assets to optimizing operations

- How CEOs are reacting to tariffs: Pricing, financial guidance, and operational footprints

- 5 connectivity and computing themes shaping the future—insights from MWC & EW 2025

- State of enterprise IoT in 2025: Market recovery, AI integration, and upcoming regulations

Related publications

You may also be interested in the following reports:

- The evolving tariff landscape: Impact on the economy and businesses

- Hannover Messe 2025—the latest Industrial IoT/Industry 4.0 Trends

- State of IoT Spring 2025

- IoT Use Case Adoption Report 2024

- IoT System Integration and Professional Services Market Report 2024–2030

Subscribe to our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.

Leave a Comment