State of enterprise IoT in 2025: Market recovery, AI integration, and upcoming regulations

In short

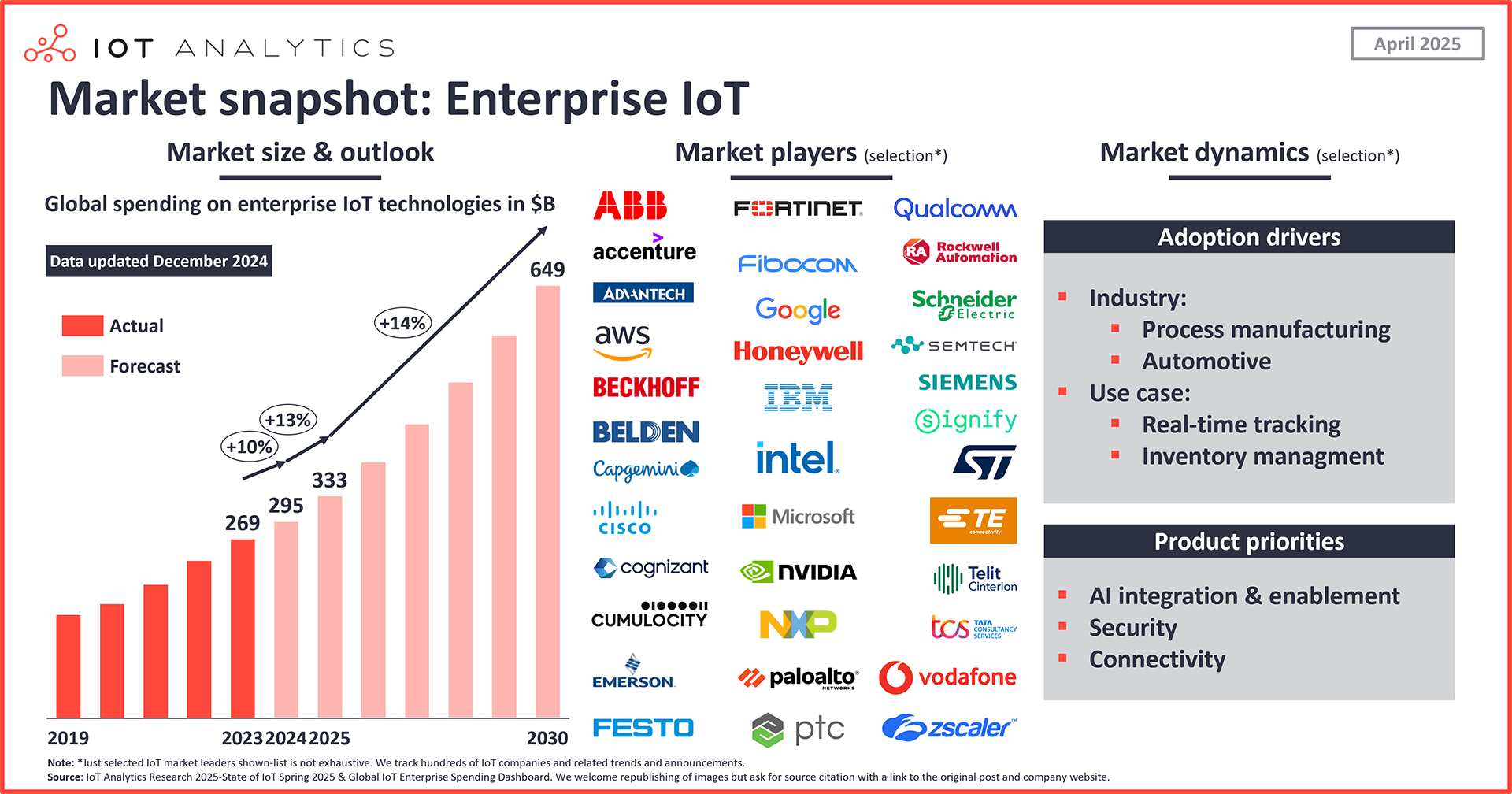

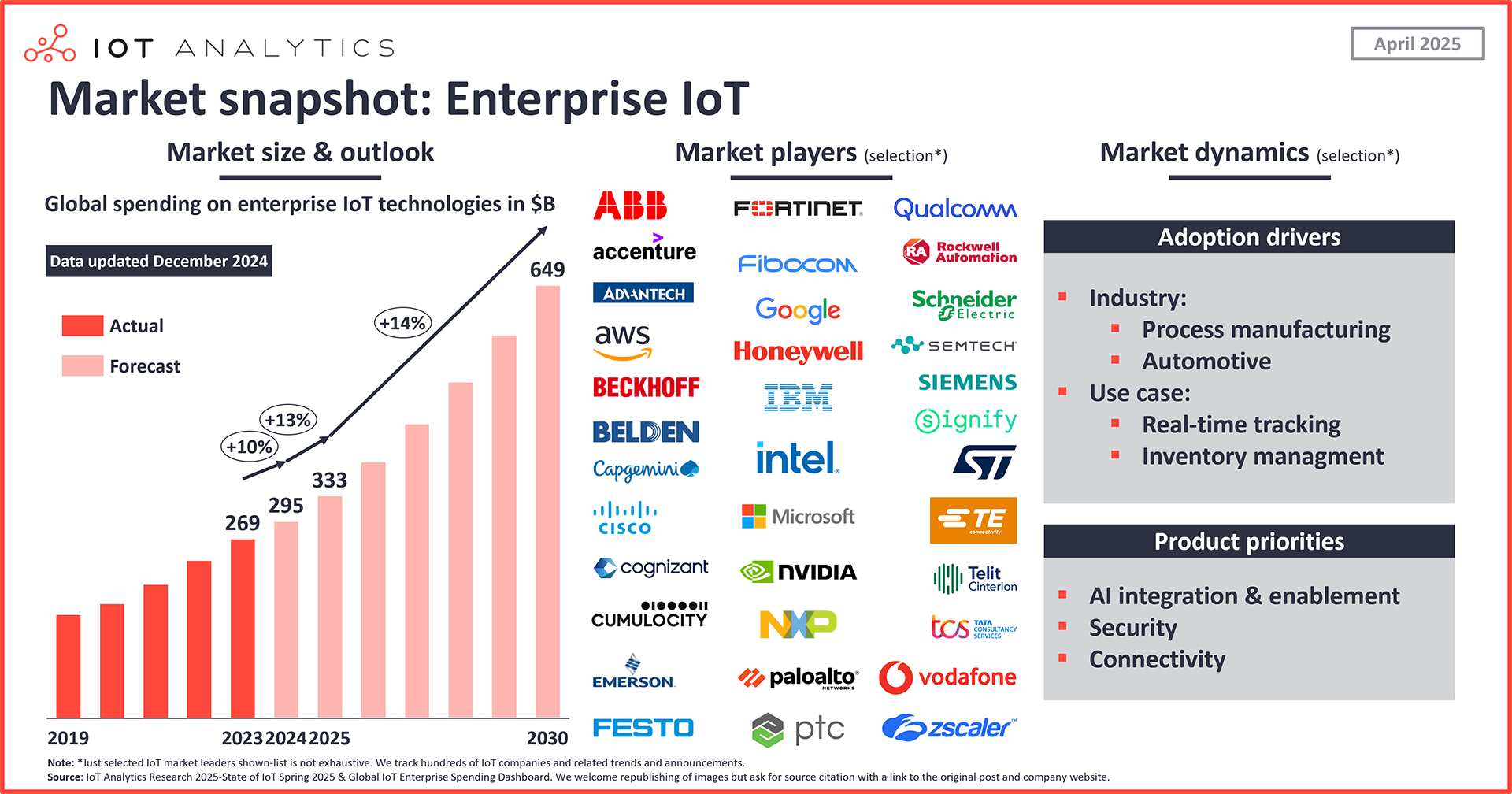

- IoT enterprise spending grew 10% in 2024, its lowest rate in over a decade, according to IoT Analytics’ 89-page State of IoT Spring 2025 report (published February 2025).

- Hardware segments struggled the most, while software and cloud-based solutions continued to expand.

- India experienced 14% YoY IoT spending growth, while Europe experienced slower IoT adoption rates.

- New IoT products in late 2024 heavily focused on AI, security, and connectivity.

Why it matters

- Vendors and end users alike should understand the latest IoT technology trends and advancements and prioritize their investments accordingly.

The insights from this article are based on

State of IoT Spring 2025

A 89-page report on the state of the Internet of Things, incl. market update, forecasts, latest trends, and more.

Already a subscriber? View your reports here →

The insights from this article are based on

IoT Enterprise Spending

An interactive dashboard and nested tracker containing global IoT enterprise spending data from 2019 to 2030.

Already a subscriber? View your trackers here →

State of IoT: Accelerated market growth expected in 2025 after sluggish 2024

Enterprise IoT spending growth at a multi-year low. According to IoT Analytics’ State of IoT Spring 2025 report, enterprise IoT spending grew 10% in 2024, the lowest market growth rate IoT Analytics has observed since covering IoT markets in 2014 . This slowdown comes on the back of macroeconomic uncertainties that led to reduced corporate investments in 2024, particularly in the IoT-heavy manufacturing sector and in Europe. Hardware segments (including industrial automation and specific semiconductor subsegments) were the hardest hit, particularly the controllers and gateways segment, which saw an 8% decline in spending in 2024 .

Key CEO quote

“[We] began to see increasing weakness in the Industrial and IoT market already during quarter three, as well as an unexpected contraction in manufacturing PMI below 50 across all regions except China.”

Kurt Sievers, CEO of NXP Semiconductors (during Q3 2024 earnings call on November 5, 2024)

IoT software and connectivity services maintained strong growth. The report shows that not everyone was hit as hard by this slowdown. IoT software—specifically infrastructure-as-a-service (IaaS) supporting IoT deployments and software-as-a-service (SaaS) supporting IoT deployments —remained resilient, experiencing 22% and 21% YoY growth in enterprise spending, respectively. In terms of investments, of the top 20 IoT-related startup investments in the latter half of 2024, 45% of the investments were related to software. Meanwhile, IoT services related to wireless connectivity experienced slightly faster YoY growth, from 17.3% in 2023 to 17.7% in 2024.

Enterprise IoT market growth is set to accelerate in 2025. Starting this year, the enterprise IoT market growth is forecasted to re accelerate, growing at 14% CAGR through 2030. Driving this recovery is spending on IoT-related SaaS and IaaS, both forecasted to grow at over 20% CAGR through the rest of the decade. Hardware is also poised to see accelerated growth, with controllers and gateways forecasted to recover to a modest 4.5% CAGR through 2030. However, specific hardware and semiconductor segments (e.g., those at the intersection of IoT and AI) are expected to see a much larger growth rate.

Key CEO quote

“We anticipate QCT IoT revenues to increase by more than 20% on a year-over-year basis with growth across consumer, industrial and networking.”

Cristiano Amon, CEO of Qualcomm (during Q4 2024 earnings call on November 6, 2024)

IoT definition

IoT Analytics defines the Internet of Things as connected physical objects that can exchange data to or from one location to another (either directly or indirectly via gateways/hubs). These objects need to be uniquely identifiable and possess the ability to autonomously collect data about their environment. IoT devices typically consist of embedded computation hardware and software and some form of network connectivity to an edge or remote computing resource.

As part of the IoT enterprise market, IoT Analytics tracks 10 individual market segments along the IoT tech stack.

| IoT Tech Stack | Definition |

|---|---|

| Security | Standalone spending on security software, hardware, and services for IoT scenarios |

| Services – Connectivity | Spending related to network access and usage for long-range wireless networks for IoT scenarios |

| Services – Professional Services | Spending on professional services in IoT scenarios |

| Software – Platforms (incl. Paas) | Spending related to modular IoT software components that are not geared towards a single use case |

| Software – Infrastructure as a Service (IaaS) | Spending related to cloud Infrastructure as a service (IaaS) for IoT scenarios |

| Software – Applications (incl. SaaS) and Others | Spending related to software applications that cater to specific IoT use cases |

| Hardware – Chipsets | Spending related to semiconductor components or modules that either individually or collaboratively contribute to the functionality of an IoT device or IoT equipment |

| Hardware – Computers, Controllers, and Gateways | Spending related to computing devices that are used for IoT setups |

| Hardware – Sensors | Spending related to sensors that are embedded within equipment and transmit raw or processed data through a standalone communication module |

| Hardware – Others | Spending related to other hardware components that are directly related to the IoT device |

IoT market growth areas and inhibitors

Along with the updated market numbers shared above, the State of IoT Spring 2025 report delves into general IoT business sentiment, general IoT sentiment by region and industry, and major trends and announcements affecting IoT. Below are general growth areas for IoT as well as key market inhibitors based on market projections and sentiments across the market.

Industries leading IoT growth

Process manufacturing and automotive to lead IoT adoption growth. Process manufacturing (e.g., oil & gas and chemicals) and automotive remain some of the strongest sectors for IoT growth. In recent years, the infrastructure and energy sectors have also seen significant IoT adoption, driven by increased energy monitoring and sustainability efforts. Energy monitoring was one of the most widely adopted IoT use cases in 2024, showing increased adoption due to sustainability initiatives across industries and regions, including smart grids and renewable energy integration.

Real-time tracking and inventory management had the highest increase in adoption. As of summer 2024, 54% of companies either are rolling out or have rolled out projects involving real-time tracking and inventory in their organizations, based on IoT Analytics research into IoT use case adoption. This share represents a 35 percentage point increase over 2021, driven by the need for optimized supply chain visibility and predictive logistics.

Regional market dynamics

India emerging as a major IoT growth hub. In 2024, enterprise IoT spending in India rose 14% YoY, driven by smart city initiatives and industrial automation. One such initiative is India’s ongoing, ambitious project to install 250 million smart electricity meters countrywide by the end of 2025.

Regulations and economic challenges affect Europe’s IoT growth. IoT adoption in Europe is starting to be impacted by the emergence of a number of strict regulatory frameworks, such as the EU’s Data Act and Cyber Resilience Act,* making compliance both a driver for IoT adoption for some but also increasingly a challenge and source of uncertainty for other IoT companies.

*Note: IoT plans to publish a report on the impacts of regulations such as the EU Data Act in mid-2025 . Those interested in accessing this and other insights reports when they are released can sign up for IoT Analytics’ IoT Research Newsletter by clicking below.

Key CEO Quote

“In Europe, we went too far and too fast on AI regulation. It’s complex for us because we have to look at regulation in every country where we operate … .”

Aiman Ezzat, CEO at Capgemini (source)

New IoT products focus on AI, security, and connectivity

In 2024, new IoT products heavily focused on AI integration & enablement, security, and better connectivity. Some of the most notable announcements found in the State of IoT Spring 2025 report include the following.

Selected Q3/Q4 2024 IoT product launches with an AI focus

- AWS announced the integration of an industrial assistant in IoT SiteWise (announced in November 2024), enabling natural language queries to analyze and visualize operational data.

- Festo , a Germany-based industrial automation company, unveiled the Festo Automation Experience (AX), which uses AI to enhance energy optimization and predictive maintenance. Festo claims the solution reduces unplanned downtime by 20% and can lower waste by up to 50%.

- Qualcomm, a US-based semiconductor and wireless technology provider, launched the IQ Series chipsets with up to 100 TOPS AI performance and SIL-3 safety for edge AI solutions in October 2024.

Selected Q3/Q4 2024 IoT product launches with a security focus

The expansion of IoT networks means companies’ cyber footprints are becoming larger, giving more prime targets for nefarious cyber actors. To address this, new IoT security products are emerging to safeguard data, prevent unauthorized access, and ensure device integrity.

- Fortinet, a US-based cybersecurity company, launched FortiDLP, an AI-enabled platform for managing data security and insider threats, in October 2024. FortiDLP aims to enhance incident analysis using generative AI to summarize and contextualize data.

- Cato Networks, an Israel-based network security company, launched security features within its SASE Cloud platform in December 2024, integrating threat prevention, anomaly detection, and real-time policy enforcement for IoT and OT devices. The system supports device discovery and segmentation across industrial environments.

Selected Q3/Q4 2024 IoT product launches with a connectivity focus

The next generation of IoT connectivity—the backbone of IoT—products is focused on expanding bandwidth, reducing latency, and providing reliable communication across diverse environments.

- Ericsson, a Sweden-based networking and telecommunications company, and US-based semiconductor provider Qualcomm collaborated with Australia-based telecommunications company Optus to deploy AI-enhanced safety systems using 5G RedCap technology. The system integrates a Snapdragon X35 modem and AI-based pedestrian detection for real-time collision avoidance in industrial settings.

Analyst takeaway and outlook on the state of IoT

IoT market recovery driven by AI, cloud, and sustainability. As covered in the State of IoT Spring 2025 report, the economic uncertainty that dampened IoT spending in core segments like manufacturing in 2024 appears to be subsiding, setting the stage for a more robust market recovery, particularly in IoT software and connectivity services. IoT Analytics expects the next wave of growth to be driven by AI integration, cloud/edge computing, and the rising importance of sustainability across sectors like energy, utilities, and smart infrastructure. At the same time, renewed uncertainty around tariffs and related supply chain shifts, pricing, and cost pressures are threatening to impact 2025 expectations. However, it is too early to know exactly what and how strong the impact will be.

The forecasted 14% CAGR through 2030, particularly in software segments like SaaS and IaaS, is indicative of the structural shift in IoT’s technology stack, moving away from traditional hardware-heavy solutions to more cloud-driven, software-centric (or even software-defined) offerings. AI will likely be a central pillar of this transformation, with some of the AI workloads increasingly inferences closed to the source (at the edge).

Hardware market to rebound. While the hardware market saw a slowdown in 2024, there are indications that controllers and gateways may experience a rebound in 2025. This potential recovery will likely be gradual, with projections indicating modest 4.5% CAGR growth through 2030. Demand for these components can be attributed in part to increasing manufacturing activity (e.g., the global manufacturing PMI has been in expansion in 2025 thus far, with March 2025 just inside of expansion territory at 50.3) along with the evolving landscape of Industry 4.0, connected and software-defined vehicles, and edge computing technologies.

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention to the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Are you interested in learning more about state of enterprise IoT?

IoT Enterprise Spending Dashboard

An interactive dashboard and nested tracker containing global IoT enterprise spending data from 2019 to 2030.

State of IoT Spring 2025

A comprehensive 89-page report on the current state of the Internet of Things, including market update, forecasts, latest trends, and more.

Related articles

You may also be interested in the following articles:

- What CEOs talked about in Q1 2025: Tariffs, rising uncertainty, and agentic AI

- Mapping 4,000 global industrial automation projects: Where Siemens, Emerson, Rockwell Automation, ABB, and Schneider Electric place emphasis

- The leading generative AI companies

- 8 notable developments in software-defined manufacturing

Related market data

You may be interested in the following IoT market data products:

- Global IoT Enterprise Spending

- Global Cellular IoT Connectivity Tracker & Forecast

Related publications

You may also be interested in the following reports:

- Quarterly trend report: What CEOs talked about in Q1 2025

- List of generative AI projects 2025

- Industrial Automation Projects Report and Database 2025

- Global IoT Enterprise Spending (Q1/2025 Update)

- Sustainability Platforms Market Report 2025–2029

Subscribe to our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.

Leave a Comment