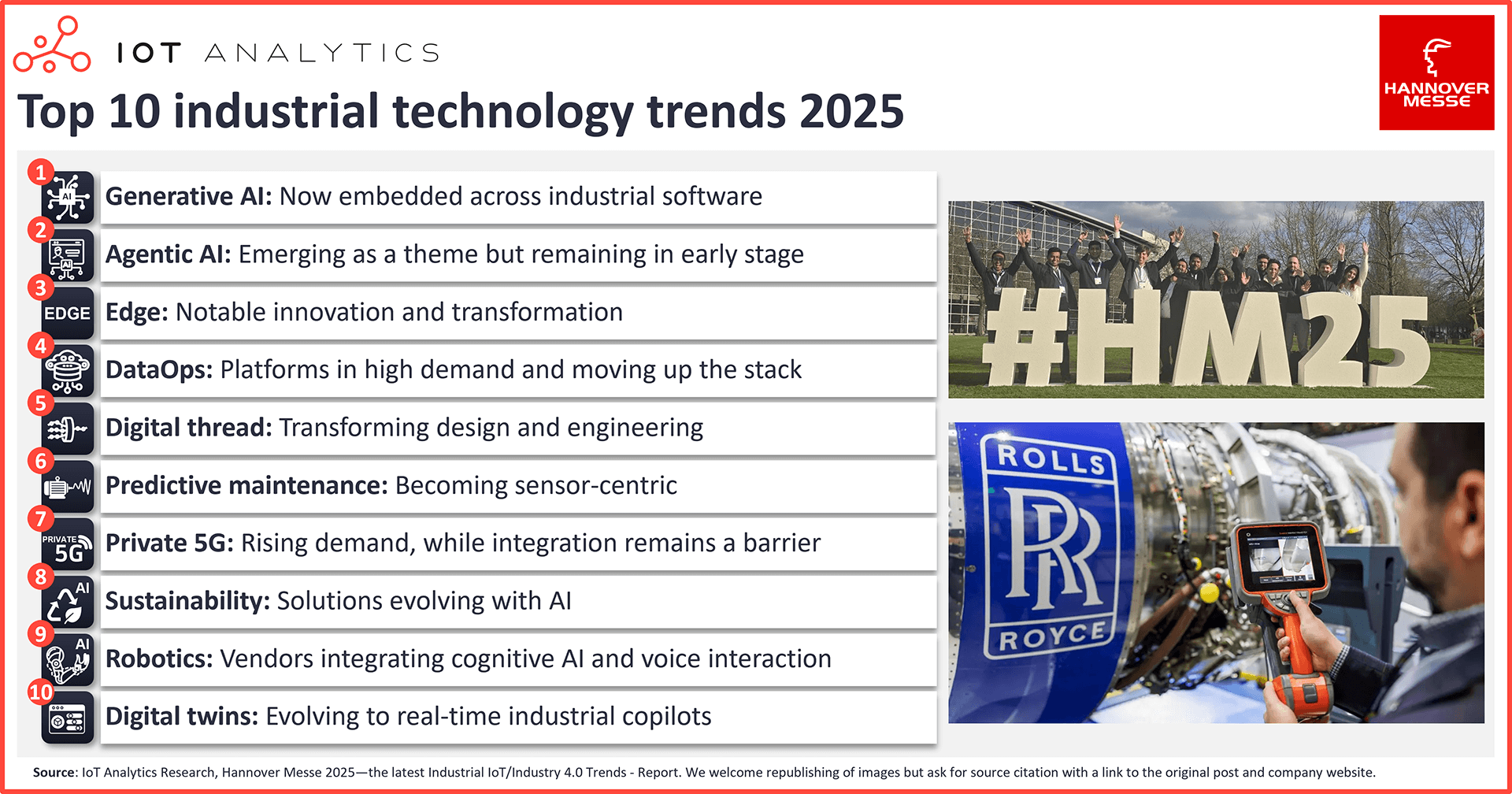

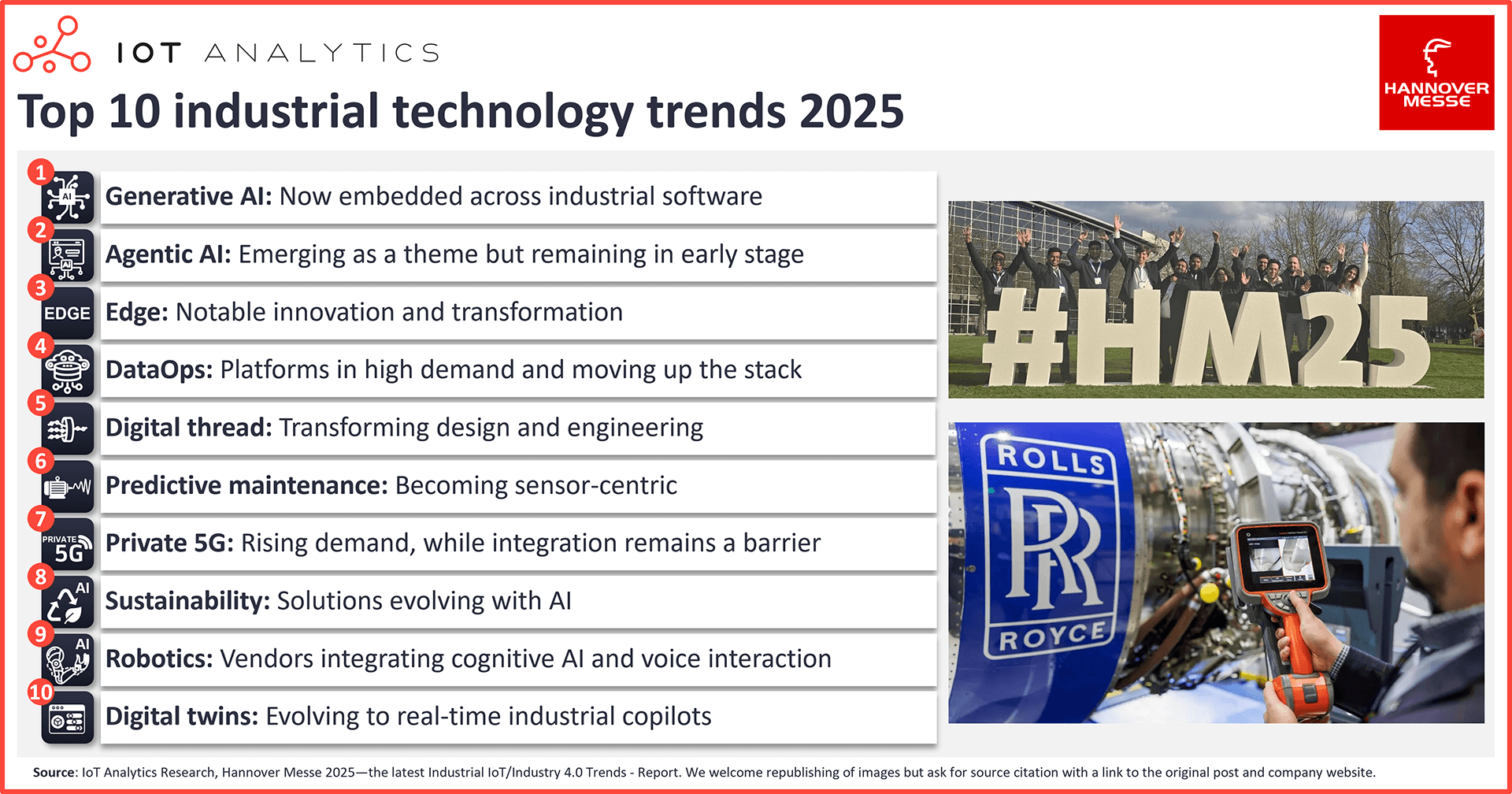

Top 10 industrial technology trends—as seen at Hannover Messe 2025

In short

- The current state of industrial technology was on full display at Hannover Messe 2025, with industrial AI at the center of attention.

- IoT Analytics had a team of 20 on the ground to uncover the latest industrial technology trends and assess the future of industrial automation.

- The team noticed an increasing prominence of edge technologies, DataOps applications, solutions-focused demonstrations, and ecosystem collaborations with AI, for the first time, clearly in the spotlight for many companies.

- IoT Analytics published a 111-page event report with 34 in-depth insights and 118 topic/vendor examples from the fair. Below, the team presents a summary of the top 10 industrial technology trends.

Why it matters

- Hannover Messe remains the world’s most important global industrial fair. Technologies showcased there are widely applicable to any industrial company.

Hannover Messe 2025

Hannover Messe (or Hannover Fair) is the top global industrial tradeshow, and it was back in action in Hannover, Germany, from March 31 to April 4, 2025. It once again showcased the latest developments and industrial technology trends.

Attendance was short of 2024’s numbers at 127,000 visitors, while the number of exhibitors remained at 4,000, which is still roughly 40% below pre-COVID levels. Still, the fairgrounds were buzzing and filled with senior executives from many leading industrial hardware, software, and service providers. During interviews with IoT Analytics in the last 2 days of the fair, many of the exhibitors conveyed that the quality of conversations and new business leads were better compared to the 2024 fair.

In all, the conference remains one of those rare fairs where you randomly walk into senior executives, like a head of engineering for a major industrial conglomerate, and not only the pre-sales representatives giving you the usual pitch.

“Hannover Messe has once again shown that it is the most important platform for industrial innovation. AI in industrial applications was of particular interest to visitors, especially those from abroad.”

Dr. Gunther Kegel, President, ZVEI

IoT Analytics had 20 team members on the ground to uncover the latest industrial technology trends and contribute to IoT Analytics’ Hannover Messe—The latest industrial IoT/Industry 4.0 trends report—available for IoT Analytics’ subscribers. In total, our team visited over 400 booths, conducted over 300 individual interviews, and attended a number of presentations to gauge and assess the state of industrial technology amid the ever-changing AI landscape and the ongoing tariff war driving CEO discussions.

The insights from this article are based on

Hannover Messe 2025—the latest Industrial IoT/Industry 4.0 Trends

A 111-page comprehensive summary of the key themes and 34 in-depth insights based on >400 booth visits, >300 individual interviews by the IoT Analytics analyst team at Hannover Fair 2025.

Already a subscriber? View your reports here →

Top 10 industrial technology trends

Apart from comparing key vendors and offerings in the report (e.g., a comparison of the 3 main hyperscalers and a comparison of 15 generative/agentic AI solutions), the IoT Analytics team compiled over 30 individual insights from their time on exhibit floors and presentations. Here, the team presents the top 10 industrial technology trends based on these insights (with select exhibitor examples where pertinent).

1. Generative AI is now embedded across industrial software

Generative AI (GenAI) has moved from concept to capability in industrial software. GenAI is no longer just a buzzword in industry—it has become a common feature across major industrial software portfolios. Nearly every leading software vendor showcased integrated GenAI functionality, though generally limited to chatbots and copilots aimed at streamlining tasks such as code generation, data analysis, and user support.

For example, Germany-based industrial automation company Siemens showcased around 20 industrial copilots spanning the entire manufacturing lifecycle—from design and planning (e.g., Design Copilot NX and Planning Copilot in Teamcenter Easy Plan) to operations (e.g., Production Copilot in Insights Hub). Further, Siemens launched its Industrial Foundation Model (IFM), built in collaboration with US-based software and technology company and hyperscaler Microsoft. IFM is a large-scale AI model trained on diverse industrial datasets, including 3D models, 2D drawings, and technical specifications. The model is designed specifically for industrial use cases, such as interpreting complex engineering information and generating data-driven recommendations.

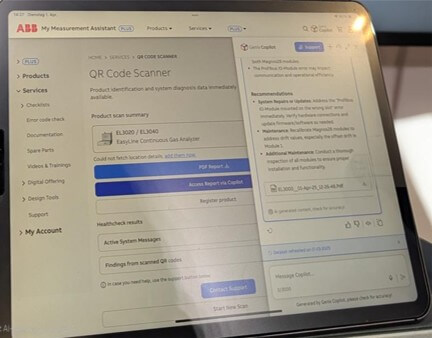

Meanwhile, Switzerland-based industrial automation company ABB showcased its Genix Copilot, demonstrating natural language-based diagnostics and shopfloor assistance. ABB embedded Genix into its Asset Performance Management and My Measurement Assistant+ platforms, enabling users to interact with instrumentation data using conversational prompts. The system provides actionable recommendations—such as troubleshooting steps and documentation links—designed to reduce downtime and improve decision speed.

2. Agentic AI emerges as a theme but remains in early stage

Agentic AI remains more promise than practice. A fair number of major software or cloud vendor featured “agentic” capabilities in their booth messaging. However, most demonstrations were rooted in relatively simple automation—such as autonomous data retrieval or predefined workflow execution—rather than true agent-based autonomy.

Multi-agent frameworks show potential, lack maturity. Hyperscalers and ISVs highlighted early efforts to build multi-agent frameworks, often positioning large language models (LLMs) as orchestrators for modular AI sub-agents. These setups show potential for combining data contextualization, diagnostic analysis, and prescriptive recommendations—but they remain in the early stages with limited field validation.

As highlighted in the report, India-based engineering technology solutions company Tridiagonal and US-based hyperscaler AWS presented an agent-based framework for industrial maintenance. Their demo featured modular agentic AI accelerators with data ingestion, root-cause diagnosis, and task-specific response agents orchestrated through a contextual pipeline. While the architecture hints at scalable, cross-functional agents in the future, the current system targets narrow use cases like equipment troubleshooting and remains a proof-of-concept.

Real multi-agent collaboration is years away. Unclear industrial use cases, limited agent interoperability, and unresolved concerns around security, error handling, and debugging are slowing momentum. That said, some enabling components were demonstrated at the fair, such as event-driven data streams, graph databases, and data normalization tools, but these remain loosely coupled. The Model Context Protocol (or MCP) framework—initially released by US-based AI research company and developer of the Claude AI model Anthropic—is emerging as a potential orchestration standard; however, adoption is still in the early stages. Nonetheless, most vendors frame agentic AI as a long-term opportunity.

“The true value of agents will only be realized when they can seamlessly communicate and collaborate across different companies and services, enabling complex, end-to-end processes.”

Director of product management at IoT platform vendor

3. Notable innovation and transformation of the edge

Full AI stacks coming to the edge. Industrial edge computing is shifting from standalone hardware devices to comprehensive AI software stacks so operational AI can be local, fast, compliant, and deeply integrated. These stacks combine tools for model training, deployment, runtime inference, and machine learning operations (or MLOps)—all optimized for industrial environments and enabling the entire AI lifecycle at the edge.

Germany-based industrial drive and control technologies company Bosch Rexroth, for example, showcased its ctrlX AUTOMATION platform, which supports AI model deployment at the edge via ctrlX CORE and ctrlX OS, leveraging ONNX runtime and Docker containers. Bosch partnered with US-based computer vision software solutions provider LandingAI to integrate the latter’s no-code model training platform, LandingLens, to enable domain-specific vision model deployment and integration into industrial workflows via the ctrlX platform.

Vision-language models (VLMs) move to low-latency edge deployments. VLMs are transitioning from cloud-centric implementations to modular, edge-optimized designs. Edge-optimized VLMs allow real-time, low-latency AI inference on premises without cloud connectivity. US-based IT and service technology company Dell—in collaboration with US-based semiconductor company NVIDIA and US-based software and consultancy services company SoftServe—showcased an advanced on-premises video search and summarization system that leverages VLMs and LLMs for object recognition, condition classification, and operational analytics—processing all data locally on Dell PowerEdge servers equipped with NVIDIA GPUs.

4. DataOps platforms in high demand and moving up the stack

DataOps platforms emerge as AI enablers. In the last few years, DataOps platforms focused on core capabilities such as data integration, contextualization, and modeling. However, leading DataOps platforms are now expanding their scope to become critical enablers of industrial AI—so critical that the IoT Analytics team observed industrial DataOps vendors being some of the most frequented booths. From one of the report’s examples, US-based industrial DataOps platform provider Litmus Automation highlighted its capabilities in supporting AI model lifecycle management at the edge, enabling real-time deployment and updating of AI models closer to data sources, which improves responsiveness and reduces cloud dependency.

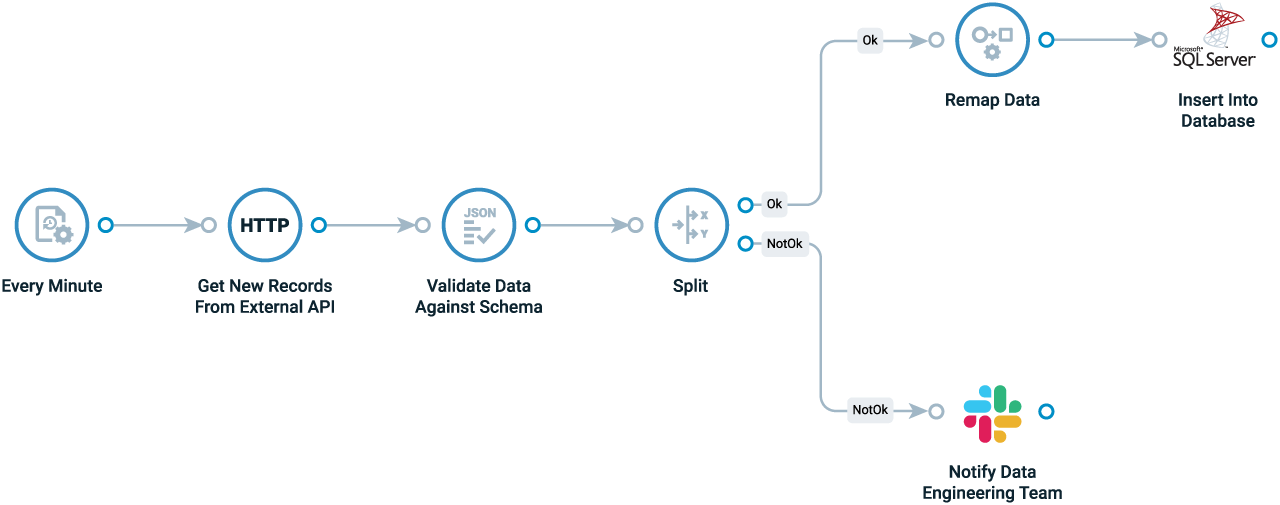

Data governance is becoming a standard expectation across the DataOps landscape. Vendors, whether from the IT domain or native to the OT space, are introducing tools that enable data governance. These solutions ensure compliance with regulations like GDPR, provide data lineage tracking, enhance observability, and more. Sweden-based stream analytics and integration software company Crosser showcased advanced edge-to-cloud orchestration focusing on streaming analytics and real-time data processing. Its platform aims to facilitate the integration and operationalization of data streams, helping manufacturers implement AI-driven workflows with low latency and high reliability.

5. Digital threads with AI are transforming design and engineering

AI and digital threads reshape engineering workflows. Design and engineering software vendors emphasized how digital threads are enabling data continuity across the product lifecycle—from initial design to production and service.

As exemplified in the report, Siemens introduced a next-generation digital thread solution, DxC, built on Asset Administration Shells (AAS). DxC allows centralized product and asset data discovery across multiple AAS servers and maps it directly into Teamcenter, Siemens’ PLM platform. This creates a unified data layer where engineers can search, retrieve, and use digital asset information without switching systems. Notably, DxC also features LLM support to auto-generate AAS entries from unstructured technical documentation, significantly reducing manual effort.

Meanwhile, US-based engineering design software company Autodesk’s Project Bernini showcased how AI is redefining early-stage design. This experimental GenAI model can convert inputs such as text prompts, images, or point clouds into 3D shapes—offering a faster, more flexible way to generate product concepts. It demonstrates a broader push to enable multi-modal design, where engineers interact with software through natural language, visual cues, and gestures.

6. Predictive maintenance becoming sensor-centric and targeting overlooked asset classes

Predictive maintenance (PdM) shifts from software to sensor-native systems. Several PdM vendors showcased purpose-built hardware with tailored analytics rather than pure software plays. The traditional approach to predicting the maintenance needs of industrial assets has been software-centric. Some vendors rely on partners for deployment, while others have built vertically integrated solutions prioritizing simplicity and fast setup. The PdM market is maturing, with differentiation increasingly tied to sensor quality, coverage, and system compatibility.

For example, Italy-based PdM solutions provider Fermai showcased its recently launched PdM system Doctor 4.0 platform, built around 4 embedded sensors, 4 auxiliary channels for external sensors, a gateway, and a cloud-based platform accessible via web and app. The solution combines sensor data with real-time control via Modbus, underlining the belief that sensor-native systems with control integration offer long-term value.

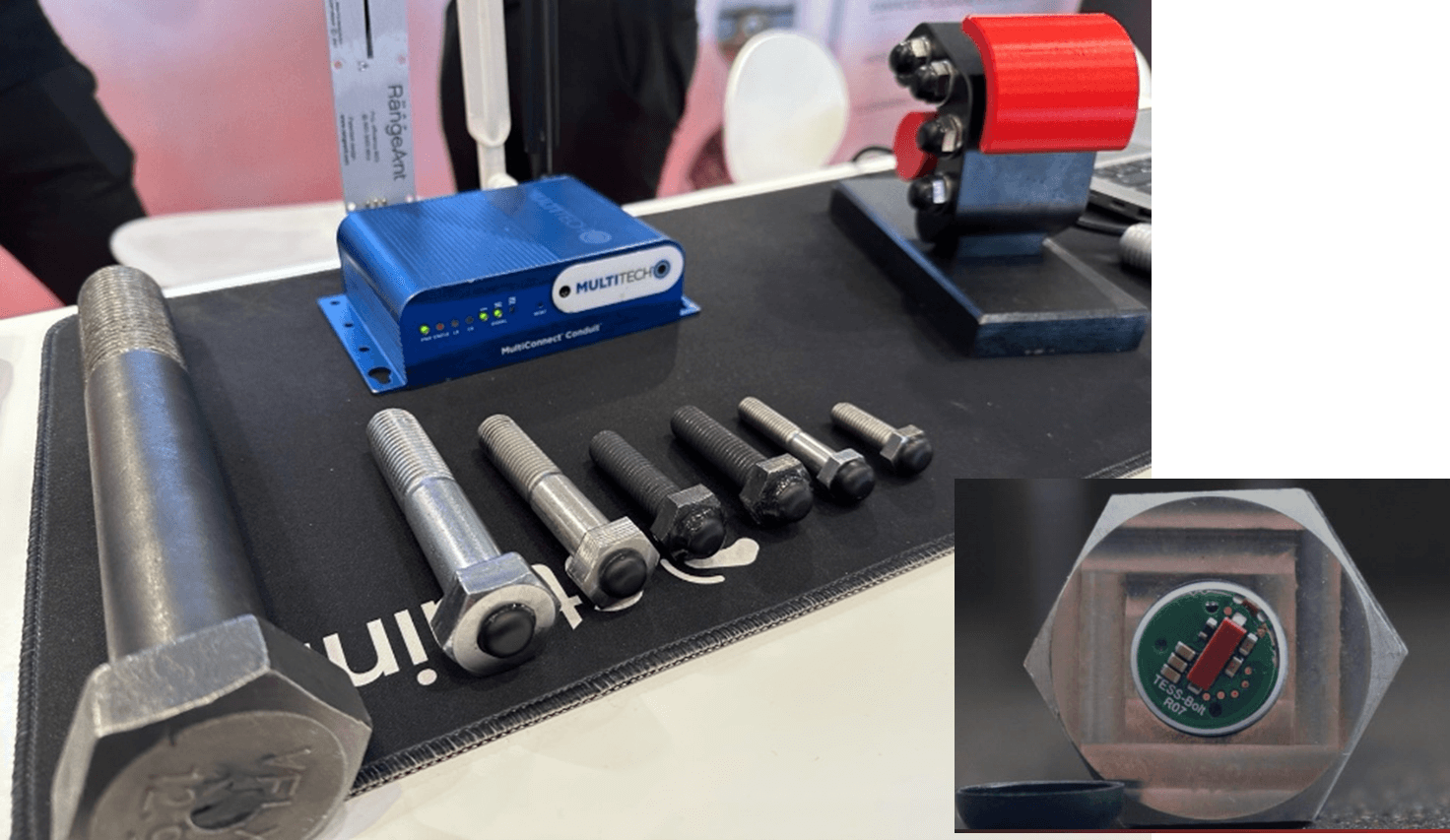

PdM expands to overlooked mechanical components. While common asset classes like motors and pumps remain central to predictive maintenance, some vendors at the fair showcased that they are targeting components that have historically received less attention—such as bolts, lubrication systems, and non-vibratory wear indicators. These areas, often responsible for hidden failure modes or warranty issues, are now being addressed with specialized sensing and AI technologies.

For instance, Sweden-based industrial technology company StrainLabs showcased a Bluetooth-enabled bolt sensor that continuously measures internal strain and temperature. This helps track preload and detect loosening before it leads to critical equipment failure—a major cost driver in sectors like transport and heavy machinery. Dashboards enable real-time monitoring and alerting based on configurable preload thresholds.

7. Private 5G demand rises, but integration remains a barrier

Private 5G adoption rises in certain regions, but ongoing challenges hinder strong growth. Several connectivity vendors highlighted the continuing growth and evolving demand for private 5G networks across various industries, notably in the US and Asia. While the adoption rate of private 5G is increasing in certain regions, the technology has still not been adopted as widely as initially expected due to challenges that vendors face.

The primary challenge highlighted by vendors is the difficulty in adapting and integrating private 5G networks with existing technology infrastructure, requiring significant technical and ecosystem adjustments. These include the need for industry-specific devices or modules, such as routers, base stations, or IoT sensors. These devices need to meet the specific needs of the industrial sector, such as low latency, high reliability, and integration with legacy systems. Regulatory and spectrum-related hurdles also play a role.

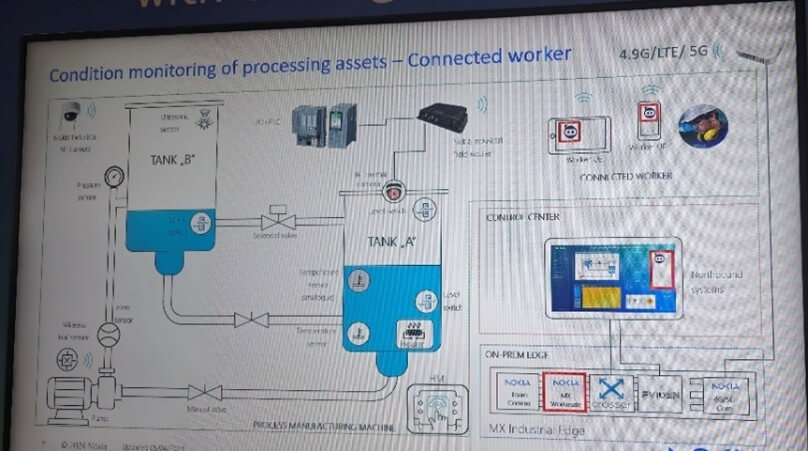

Despite these challenges, real-world implementations are expected to grow in the coming years. An example of a current application in the report is Finland-based telecommunications and IT solutions company Nokia’s real-time industrial safety and asset monitoring solution powered by GenAI, edge computing, and private 5G. In a demo, the company showed a closed-loop automation system where multimodal sensor data, computer vision, and GenAI collaborate to detect hazards and agentic capabilities to trigger autonomous safety responses and guide connected workers—all executed entirely at the edge without cloud dependency.

8. Sustainability solutions evolve with AI

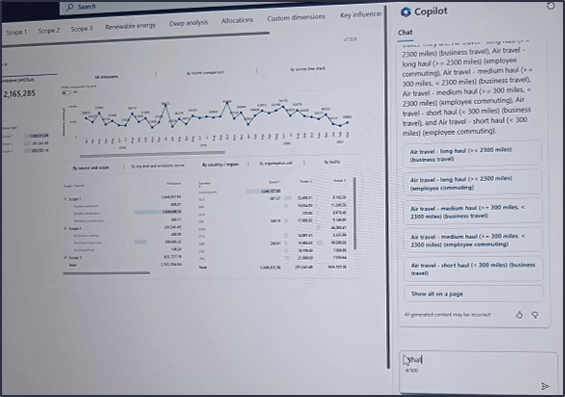

AI improves emissions visibility and compliance efficiency. Sustainability applications such as emission tracking systems, carbon dioxide footprint management, and ESG reporting tools are being upgraded through AI. These enhancements aim to help manufacturers achieve better data visibility and generate more reliable estimations to optimize energy consumption along their production lines. Notable use cases highlight the role of AI in filling data gaps, increasing the accuracy of carbon footprint estimations, and improving energy consumption through modeling techniques and energy consumption forecasting.

AI is also used to streamline compliance reporting by mapping the same energy metric to different regulation frameworks. An example comes from Avanade, a US-based joint venture between Microsoft and US-based Ireland-based professional services company Accenture. Its EU Carbon Border Adjustment Mechanism (CBAM) Agent aims to streamline emissions tracking and compliance reporting. Avanade integrated this solution into Microsoft Cloud for Sustainability and built it using Microsoft’s Copilot Studio and Azure OpenAI Service.

9. Cognition coming to robotics

Vendors integrating intuitive voice control. Robotics vendors are working to integrate cognitive AI and voice interaction into their robots. The goal is to make it easier for users to collaborate with robots by giving voice commands instead of manually instructing them. This approach is expected to help improve flexibility, reduce setup time, and make robots more accessible to non-expert users in manufacturing and logistics. Germany-based cobot startup Neura Robotics, for instance, recently added a voice command feature to its cognitive robot called MAiRA, which can now be instructed through simple voice commands. The robot responds to spoken instructions, making human–robot interaction more intuitive by allowing users to control and teach the robot via voice rather than complex coding.

10. Digital twins evolve from virtual replicas to real-time industrial copilots

Digital twins become AI-driven optimization tools. Vendors showcased how digital twins are evolving, with several highlighting how these systems are now serving as real-time copilots for operations, training, and quality control. For instance, Germany-based automotive service provider EDAG Engineering showcased a multi-layered factory twin that acts as an intelligent assistant across the production lifecycle. Built on NVIDIA Omniverse, EDAG’s smart factory platform integrates real-time data, simulation, and GenAI. It enables use cases such as AI-guided maintenance, virtual operator training, and project management support.

Meanwhile, Siemens demonstrated how digital twins now feed directly into real-time optimization and robotics training. At its Erlangen, Germany, motion control plant, Siemens integrates NVIDIA Omniverse Replicator with its Xcelerator platform to synthetically generate training data for robots. These AI-enhanced twins simulate equipment behavior and material flow, enabling process validation and layout optimization before changes are applied on the physical shop floor.

Putting the observations into perspective

Hannover Fair 2025 did not present any new, radical technology breakthroughs; However, it showed an evolution that is clearly led by AI throughout the entire manufacturing lifecycle from R&D and manufacturing to service and operations. While IoT Analytics’ market research has shown that the advent of GenAI has led to increased AI adoption in the last 2 years, for the first time, it is now clearly visible on the exhibition floor. The move to a smarter edge is also visible. In the team’s view, agentic AI is clearly the next big thing, although it may still be a few years out.

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention to the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Are you interested in learning more about the latest industrial technology developments?

Already a corporate research subscriber?

Access this report here →

Related articles

You may also be interested in the following articles:

- The evolution of enterprise IoT asset tracking: From locating assets to optimizing operations

- How CEOs are reacting to tariffs: Pricing, financial guidance, and operational footprints

- State of enterprise IoT in 2025: Market recovery, AI integration, and upcoming regulations

- Mapping 4,000 global industrial automation projects: Where Siemens, Emerson, Rockwell Automation, ABB, and Schneider Electric place emphasis.

- Winners and losers in the generative AI value chain

- The leading generative AI companies

- The rise of sustainability platforms: $1.3 billion market in 2024 amid climate records

Related publications

You may also be interested in the following reports:

- IoT Asset Tracking & Visibility Adoption Report 2025

- State of IoT Spring 2025

- Industrial Automation Projects Report and Database 2025

- Sustainability Platforms Market Report 2025–2029

- Generative AI Market Report 2025-2030

Subscribe to our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.

Leave a Comment